D

David Kaaret

Guest

The financial messaging standard ISO 20022 is impacting the financial world. The synergy between ISO 20022 and Progress MarkLogic revolutionizes financial data management. Learn how the synergy between ISO 20022 and MarkLogic enables easy integration, enhances data quality and drives innovation in the ever-changing financial environment.

The financial world is gradually migrating to ISO 20022, providing a uniform messaging standard that responds to the continuously increasing needs of financial organizations. To fully leverage the benefits of ISO 20022, building payments projects on technology optimized for the new payment world is essential.

ISO 20022 is an international financial messaging standard that aims to provide a common language and methodology for data exchange between financial institutions and systems. It has the potential to enhance many aspects of payments, including analytics, processing efficiency, subpoena response and interoperability between payment systems. It may also increase the complexity of processing and accessing payment messages, potentially increasing risk and the cost and effort of implementing payment projects.

The ISO 20022 standard is having a significant impact on payment systems. The SWIFT FIN message types (MT) used today were designed to be lightweight and did not carry detailed information about the payment throughout its journey. Not having information such as original message ID, original amount and other critical data available as part of the message creates difficulties in many areas, including payments processing, analytics and compliance. In contrast to the old messaging standard, the ISO 20022 payments message equips business institutions with an extensive and structured data model, which includes more data about transactions than legacy messages.

The migration timeline from SWIFT FIN to ISO 20022 is a complex matter. Unlike SWIFT FIN, ISO 20022 is XML based. XML is a rich and powerful approach to storing and describing data. Many modern data processing technologies do not natively support XML, preferring to focus on simpler JSON or relational based formats. As a result, with many approaches, implementing ISO 20022 requires extensive hand coding and parsing of data with an increased possibility of error.

Progress MarkLogic generally reduces the effort of handling XML documents and ISO 20022 payments documents specifically. MarkLogic provides native support for XML and XQuery (XML query), JSON, JavaScript and other formats and languages. XQuery was designed to fully access data in XML files (understanding XML structures and namespaces). In its early years, MarkLogic was known as “the XML database.”

As a result of its XML support, many of the queries needed to use ISO 20022 messages can be done out of the box with MarkLogic directly against the messages with no processing of the data required. Simply load the data into MarkLogic and subject matter experts can immediately begin pulling the needed data with minimal preparation.

In addition to its native capabilities, MarkLogic provides an ISO 20022 Payments “Starter Kit” to accelerate time to market. The starter kit contains all the information needed to prepare financial organizations for the transition to ISO 20022. The starter kit aims to help subject matter experts to save time in the migration timeline, reduce costs and improve the efficiency of their operations while they embark on new projects and initiatives.

In addition to XML, many uses of payments data require integrating it with other data. Data may originate from relational systems, come from JSON files, include semantic graphs and geospatial information, or be based on facts extracted from Word or PDF files. Most ISO 20022 implementations handle this with multiple data and technology stacks. Each data type is handled separately and the responsibility for integrating the data and the technologies used to access the data is left to the application development team.

MarkLogic greatly eases this effort. MarkLogic combines all these data types and the technologies to access them into a single unified platform. Data from any source can be projected as SQL views, making it easy for users to access and analyze.

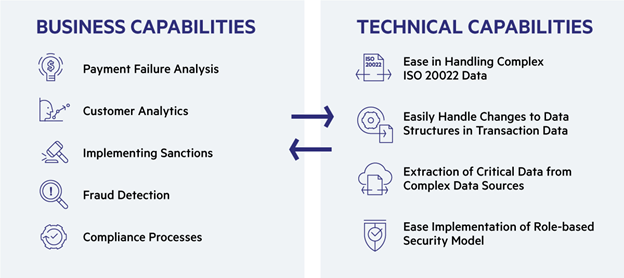

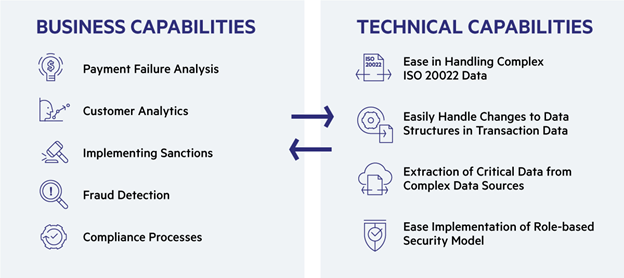

Due to MarkLogic’s support for XML-based messages and its multimodal capabilities, business and technical needs can be greatly simplified. Here are some other use cases where your business can benefit from the implementation of ISO 20022 with MarkLogic.

Many financial institutions and infrastructures have already adopted the global ISO 20022 program for their payments and reporting exchanges, and many more are expected to adopt it until 2024. But the question is, is your financial institution ready?

Continue reading...

The financial world is gradually migrating to ISO 20022, providing a uniform messaging standard that responds to the continuously increasing needs of financial organizations. To fully leverage the benefits of ISO 20022, building payments projects on technology optimized for the new payment world is essential.

What is ISO 20022?

ISO 20022 is an international financial messaging standard that aims to provide a common language and methodology for data exchange between financial institutions and systems. It has the potential to enhance many aspects of payments, including analytics, processing efficiency, subpoena response and interoperability between payment systems. It may also increase the complexity of processing and accessing payment messages, potentially increasing risk and the cost and effort of implementing payment projects.

What’s Changing with ISO 20022?

The ISO 20022 standard is having a significant impact on payment systems. The SWIFT FIN message types (MT) used today were designed to be lightweight and did not carry detailed information about the payment throughout its journey. Not having information such as original message ID, original amount and other critical data available as part of the message creates difficulties in many areas, including payments processing, analytics and compliance. In contrast to the old messaging standard, the ISO 20022 payments message equips business institutions with an extensive and structured data model, which includes more data about transactions than legacy messages.

The migration timeline from SWIFT FIN to ISO 20022 is a complex matter. Unlike SWIFT FIN, ISO 20022 is XML based. XML is a rich and powerful approach to storing and describing data. Many modern data processing technologies do not natively support XML, preferring to focus on simpler JSON or relational based formats. As a result, with many approaches, implementing ISO 20022 requires extensive hand coding and parsing of data with an increased possibility of error.

What is the Value of Integrating Progress MarkLogic and ISO 20022?

Progress MarkLogic generally reduces the effort of handling XML documents and ISO 20022 payments documents specifically. MarkLogic provides native support for XML and XQuery (XML query), JSON, JavaScript and other formats and languages. XQuery was designed to fully access data in XML files (understanding XML structures and namespaces). In its early years, MarkLogic was known as “the XML database.”

As a result of its XML support, many of the queries needed to use ISO 20022 messages can be done out of the box with MarkLogic directly against the messages with no processing of the data required. Simply load the data into MarkLogic and subject matter experts can immediately begin pulling the needed data with minimal preparation.

In addition to its native capabilities, MarkLogic provides an ISO 20022 Payments “Starter Kit” to accelerate time to market. The starter kit contains all the information needed to prepare financial organizations for the transition to ISO 20022. The starter kit aims to help subject matter experts to save time in the migration timeline, reduce costs and improve the efficiency of their operations while they embark on new projects and initiatives.

Beyond 20022

In addition to XML, many uses of payments data require integrating it with other data. Data may originate from relational systems, come from JSON files, include semantic graphs and geospatial information, or be based on facts extracted from Word or PDF files. Most ISO 20022 implementations handle this with multiple data and technology stacks. Each data type is handled separately and the responsibility for integrating the data and the technologies used to access the data is left to the application development team.

MarkLogic greatly eases this effort. MarkLogic combines all these data types and the technologies to access them into a single unified platform. Data from any source can be projected as SQL views, making it easy for users to access and analyze.

Due to MarkLogic’s support for XML-based messages and its multimodal capabilities, business and technical needs can be greatly simplified. Here are some other use cases where your business can benefit from the implementation of ISO 20022 with MarkLogic.

Many financial institutions and infrastructures have already adopted the global ISO 20022 program for their payments and reporting exchanges, and many more are expected to adopt it until 2024. But the question is, is your financial institution ready?

Continue reading...