S

Suzanne Scacca

Guest

In order for banks to remain relevant in this digital economy, they’re going to need to ditch the old-school product-centric marketing approach and embrace customer-centric marketing.

How do people choose who to bank with these days? For starters, it’s no longer a choice based on which banking institutions are nearby or offer the most convenient access to ATMs. Consumers can manage all of their financial transactions from their computers or smartphones.

It’s not simply a matter of moving from physical to digital banking though. The success of fintech has shown us that consumers want hi-tech features and enhanced experiences.

As traditional financial institutions begin to catch up to online-only banks in terms of technology, there remains yet another challenge for them to tackle. And it has to do with their approach to marketing.

In the following post, we’re going to look at seven things that traditional banking institutions can do to level up the customer experience via their content marketing strategy. If they want to compete in this digital economy, content is the way to get and stay ahead.

Because fintech was born online, these companies have easily mastered the art of providing an outstanding customer experience via content marketing. It’s part of their DNA.

It’s time now for traditional financial institutions to catch up. Here are some ways to do it:

Every successful content strategy starts with user research. For banks, this is an especially important step. Unlike, say, a web design agency that targets small business owners and entrepreneurs, banks typically serve everyone. So you can’t just create content for one particular segment of your customers and not the other. Nor can you write content for everyone and make your blog or knowledge center be a free-for-all.

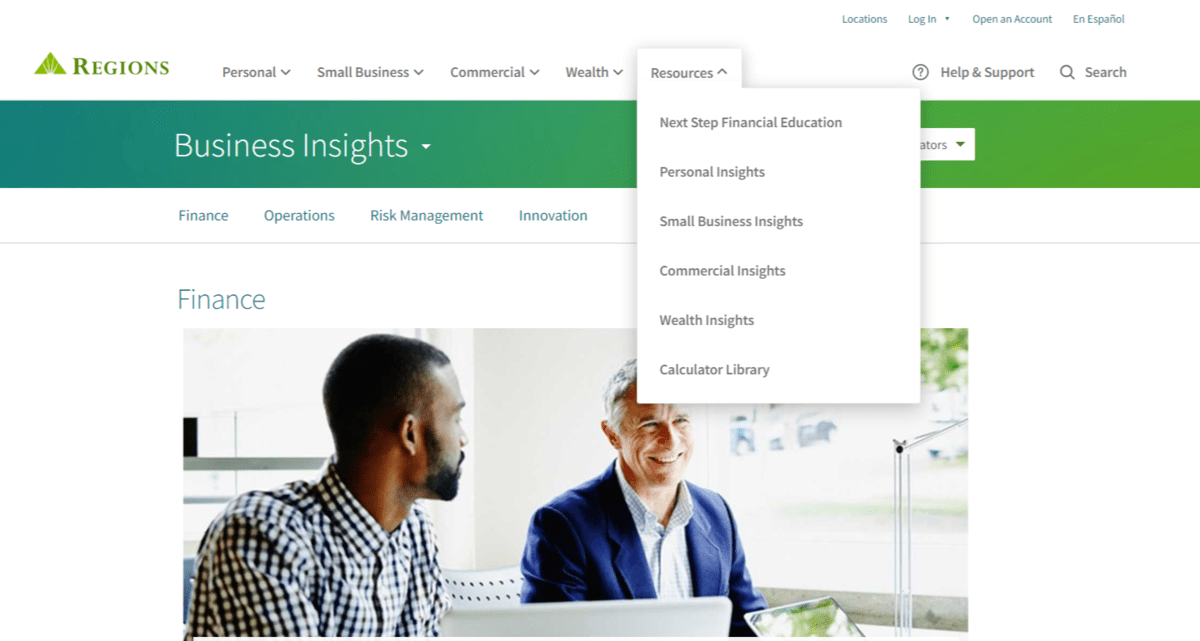

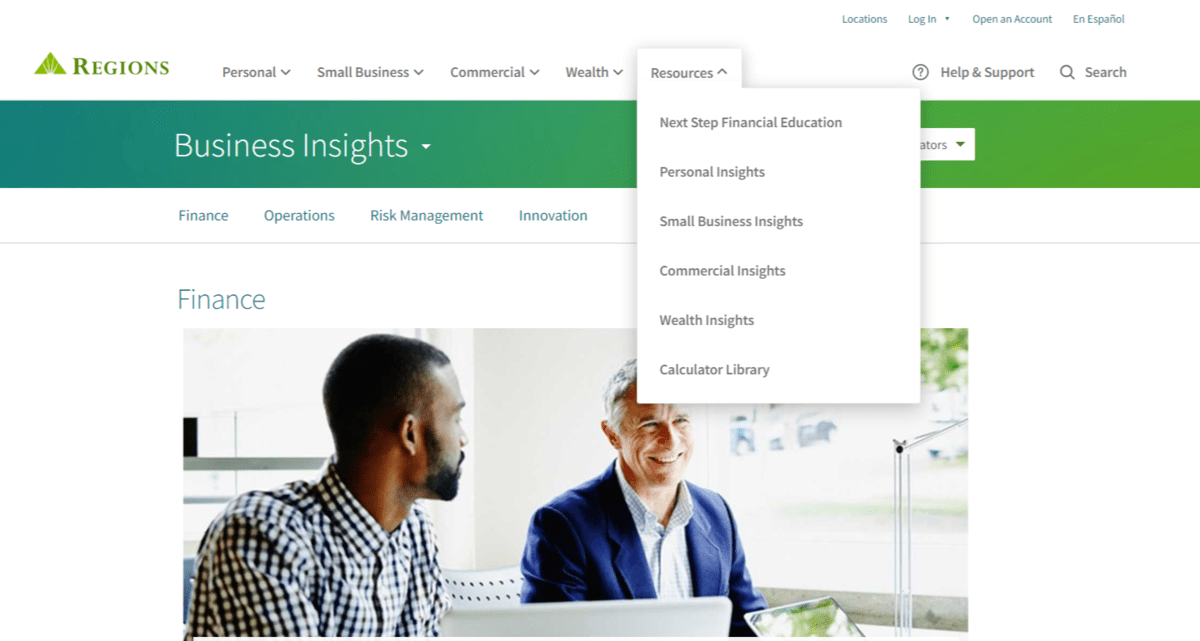

What you’ll need to do first is identify the major user segments that you serve and want to create content for. Let’s use the example of Regions Bank.

The Resources area of the navigation contains “Insights” (i.e., articles) for different customer segments:

This segmentation of content enables Regions Bank to tailor their content to their different customers’ financial needs and goals. It also makes it easy for users to find relevant content from the navigation. This wouldn’t be possible for Regions Bank to do if they didn’t know their customers well.

Identifying your customer personas is just the first step. You also need to understand what your typical customer’s journey looks like. For example:

You want to create valuable and informative content for people at every stage, even if they’re not your customers yet. But the more you get to know the people you’re targeting, the better-crafted your content will be. That could be the difference between them deciding to open an account with your financial institution versus a fintech solution or another bank.

Omnichannel customer experience (CX) is a holistic and integrative approach to serving customers.

At the core of this experience sits your digital products. So your website and mobile app need to be reliable, secure, intuitive and useful. They also need to seamlessly work with and talk to each other so your customers can pick up where they left off with ease.

Explore Gene De Libero’s theory that these three vital strategies highlight the changing face of consumer engagement: multichannel, omnichannel and omnipresent marketing.

In addition, your digital products should be built for their unique use cases. For instance, a bank’s website is a useful tool for attracting prospective customers via SEO, blogging and free resources. The app, on the other hand, is a good tool for onboarding customers and giving them real-time access to all the tools and insights they need to manage their money.

Omnichannel CX takes into account everything else your bank does online and offline. For example:

The content you publish to any one of these channels should factor in your different user segments while also accounting for the context in which the content appears.

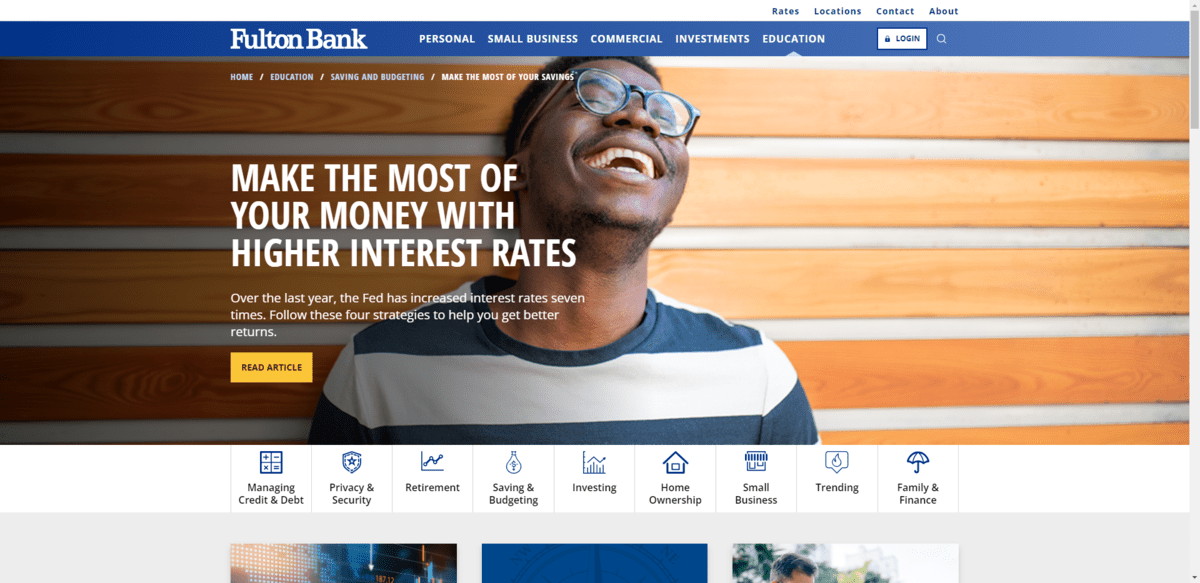

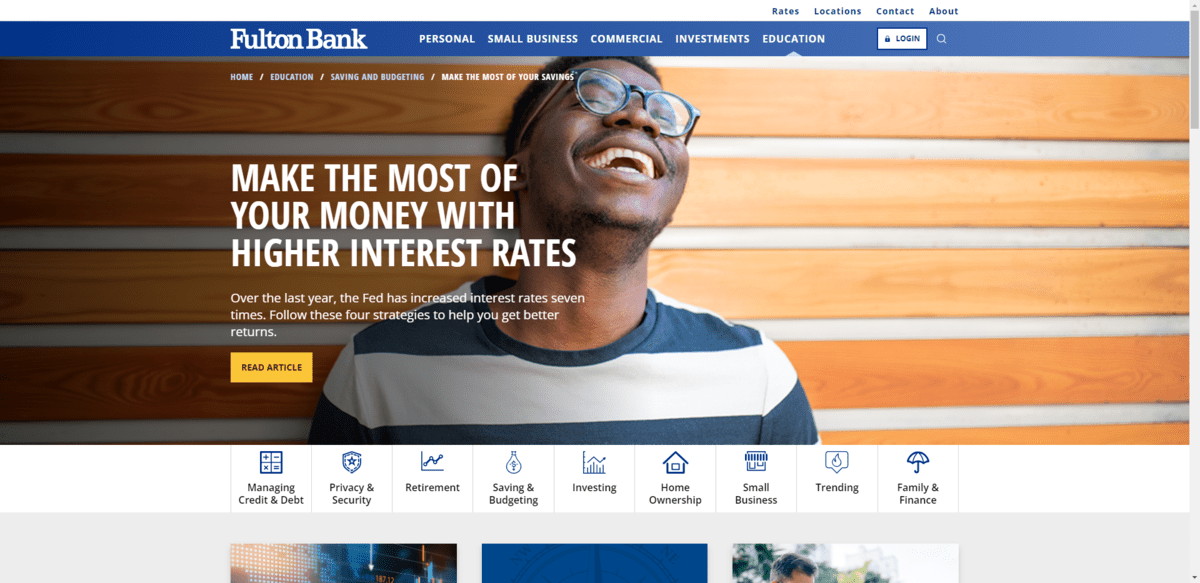

Let’s look at Fulton Bank’s blog:

This is a great educational resource for banking customers as well as non-customers. They’ll learn about things like saving and budgeting, investing, home ownership, managing debt and more.

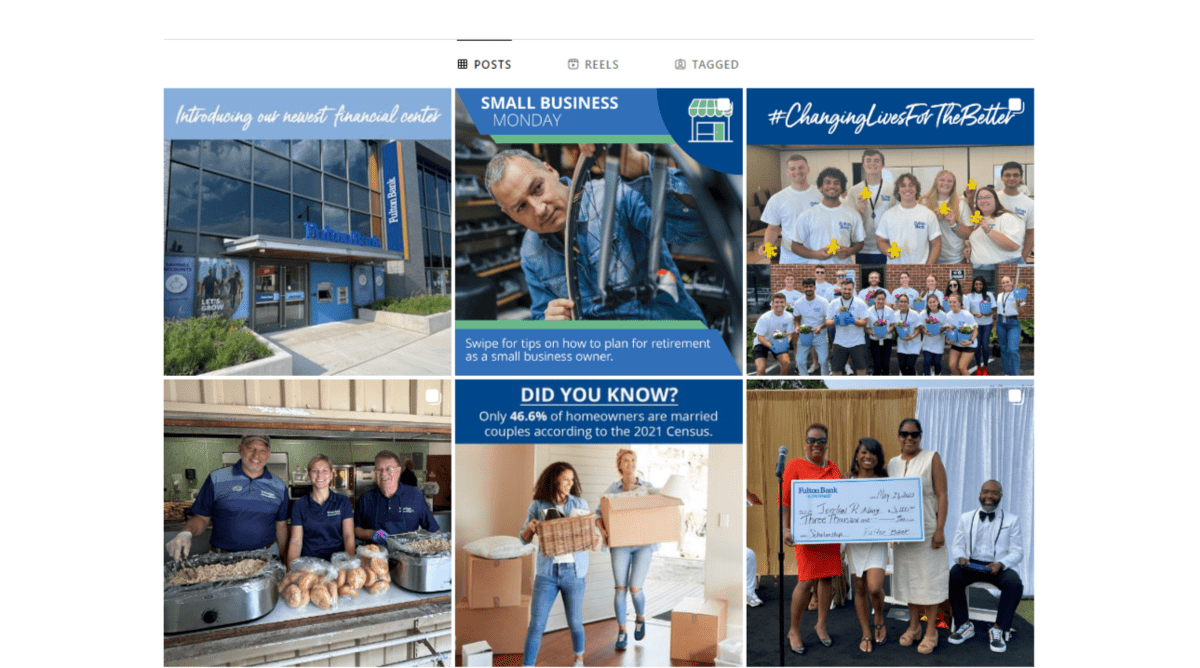

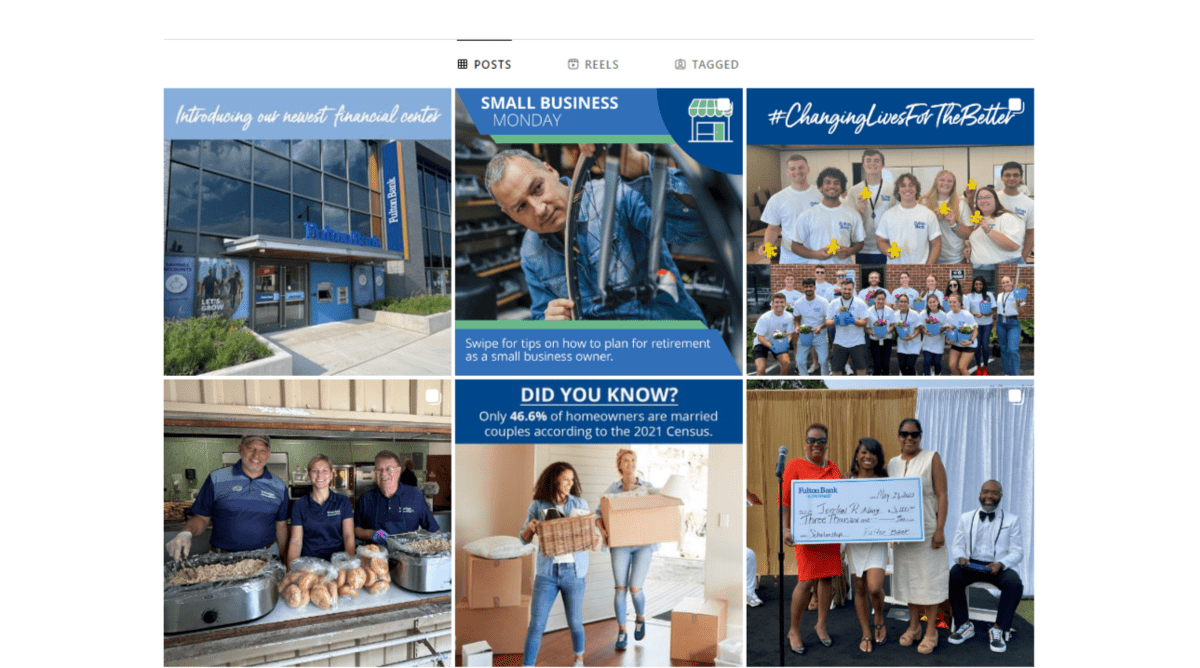

But when you go to Fulton Bank’s Instagram, you won’t find the same kind of content:

The Instagram page is really about putting a face to the Fulton Brand bank and its customers. It demonstrates how much this financial institution cares about its customers and communities. At the same time, it fits perfectly within the larger Fulton Bank brand.

This is what a great omnichannel strategy looks like. Customer-centric content that’s custom-made based on the platform. And each platform seamlessly integrates with the company’s digital products and other channels.

When it comes to deciding what type of content to share, banks generally have to play it more conservative.

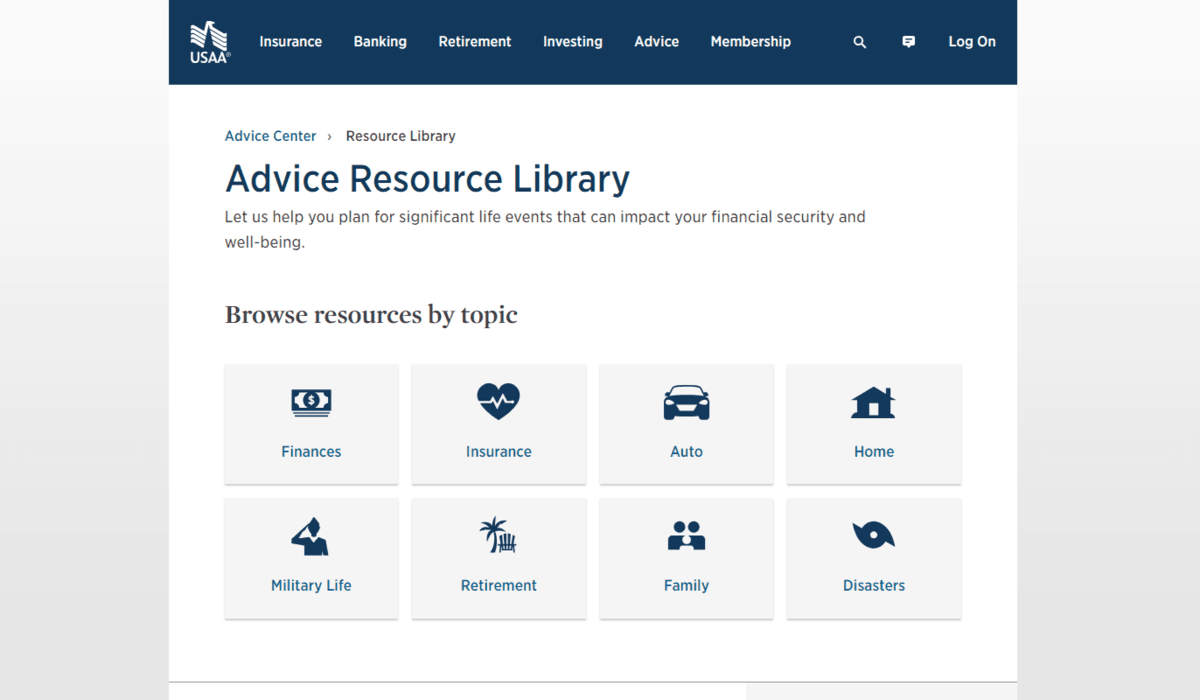

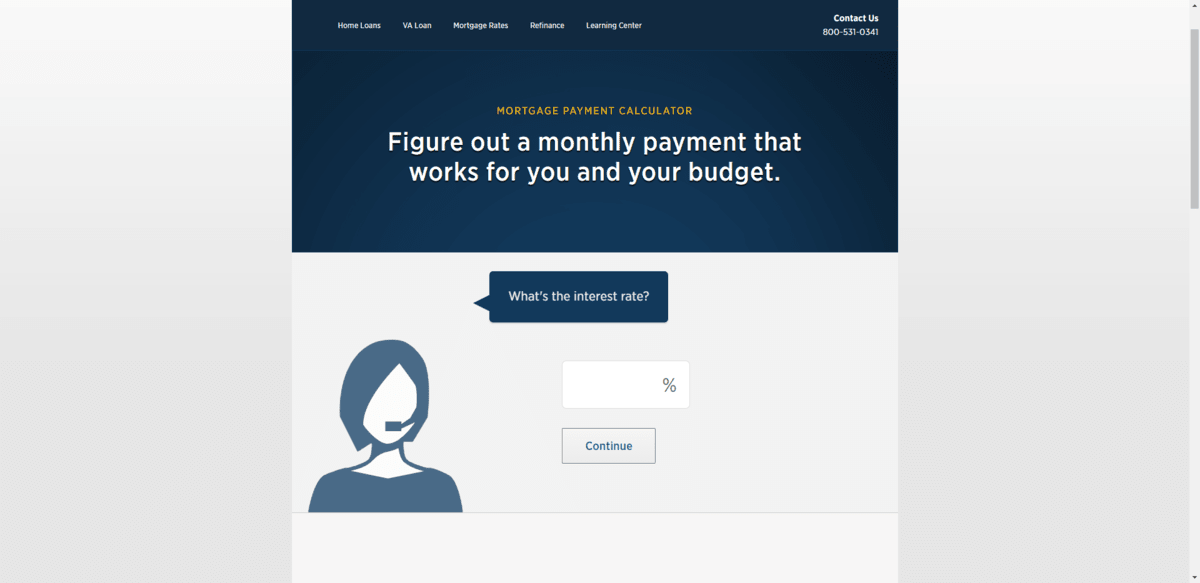

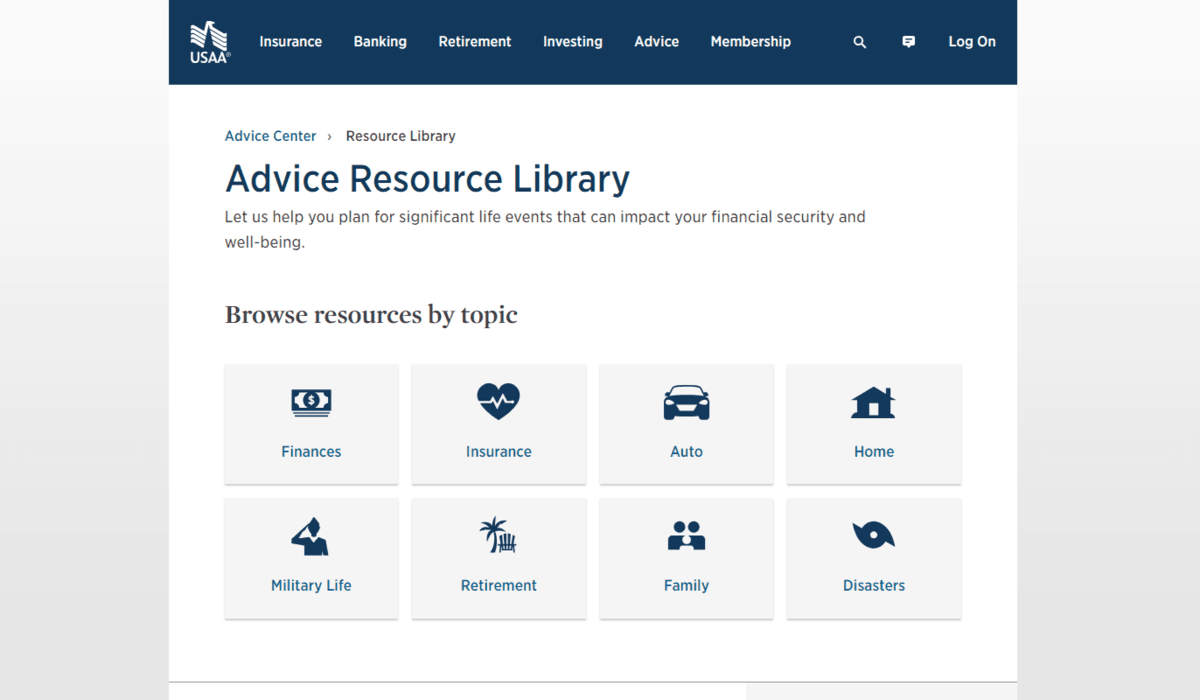

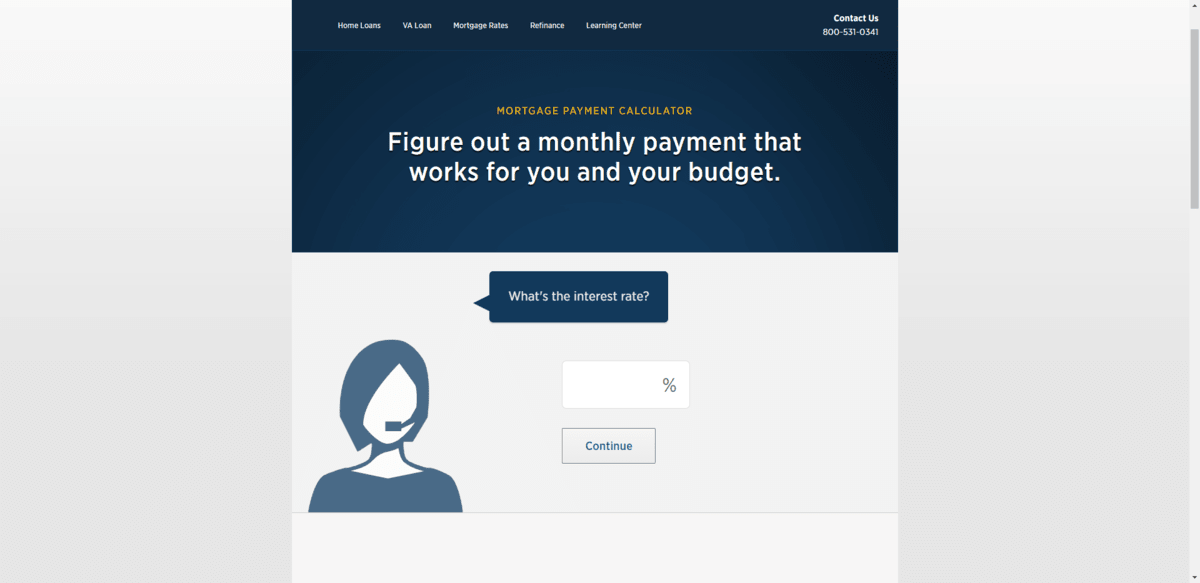

On a website, you’ll almost always find a blog along with free resources. The Advice section of the USAA website is a good example of how to present this kind of content:

The top of the Advice page has a list of the blog’s categories:

When users scroll down, they’ll find the blog feed as well as a list of resources like the Auto Loan Calculator, Mortgage Payment Calculator and Military Separation Checklist.

Many of these resources are interactive, conversational tools. They’re built to feel like you’re talking with a financial advisor and being carefully guided through the process of making some of life’s biggest financial decisions.

Banks have to create content for their other channels as well.

On mobile apps, for instance, users should be shown more personalized content. That’s the benefit of making a digital product specifically for customers that you’ve collected data from. Rather than give them a blog full of generic advice, you can provide them with meaningful advice and insights that relate to their accounts, activity and goals.

When traditional banking institutions didn’t have fintech to contend with, they could get away with product-driven marketing.

“Sign up for a checking account and get $250 today!” might have been the messaging that appeared in online ads, mailers, Instagram posts and on the website. But the modern consumer doesn’t want to have products and services pushed on them without first understanding:

WHAT’S IN IT FOR ME?

This is why the 80/20 content marketing strategy is the way to go when pivoting to a customer-centric approach. This means that 80% of what you create is high-value content that’s non-promotional.

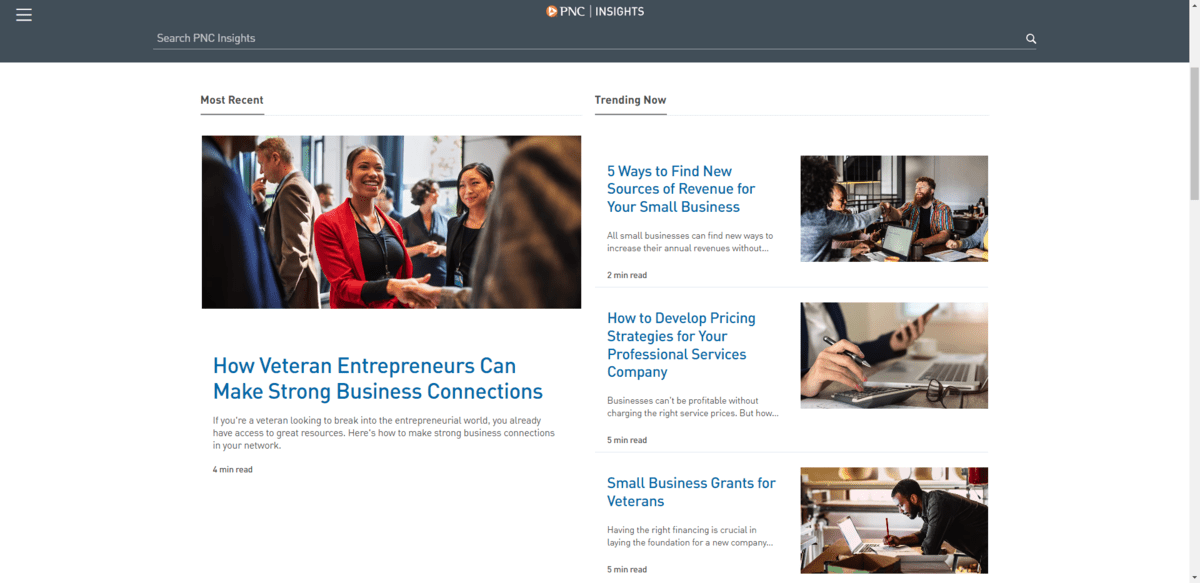

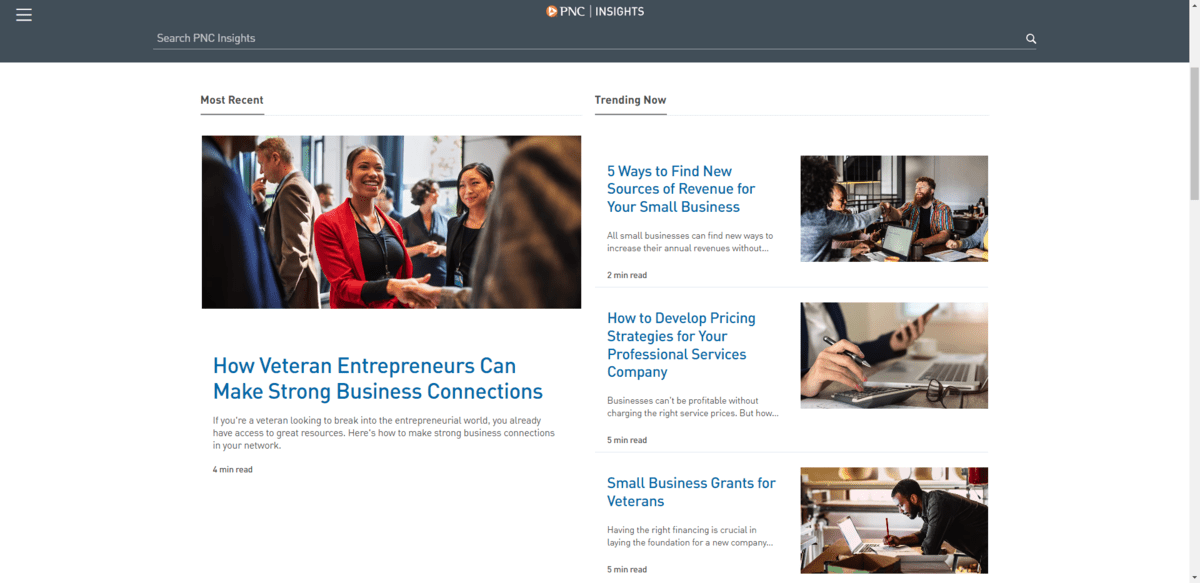

The PNC Insights blog is a good example of how to build trust in your bank and its products through high-quality content:

The remaining 20% of your content can be promotional, but it should still take an empathetic approach. If you want to sell to the digital consumer, then you can’t make it only be about what you’re selling. You have to give them a reason to seriously consider it.

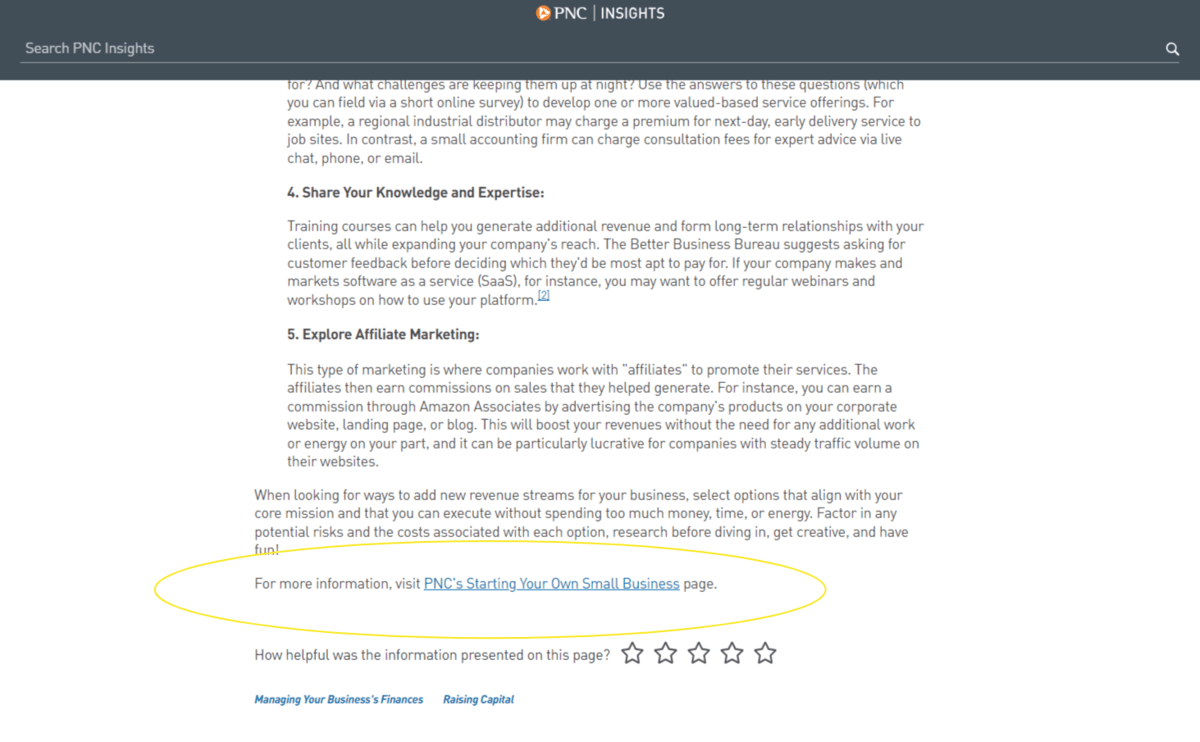

Another way to approach this is to shape the content you write to be 80% non-promotional and 20% promotional. The way that usually works is to tackle a super valuable topic and spend the majority of the article unpacking it. Then, in the conclusion, you offer up your banking product or service as a potential solution.

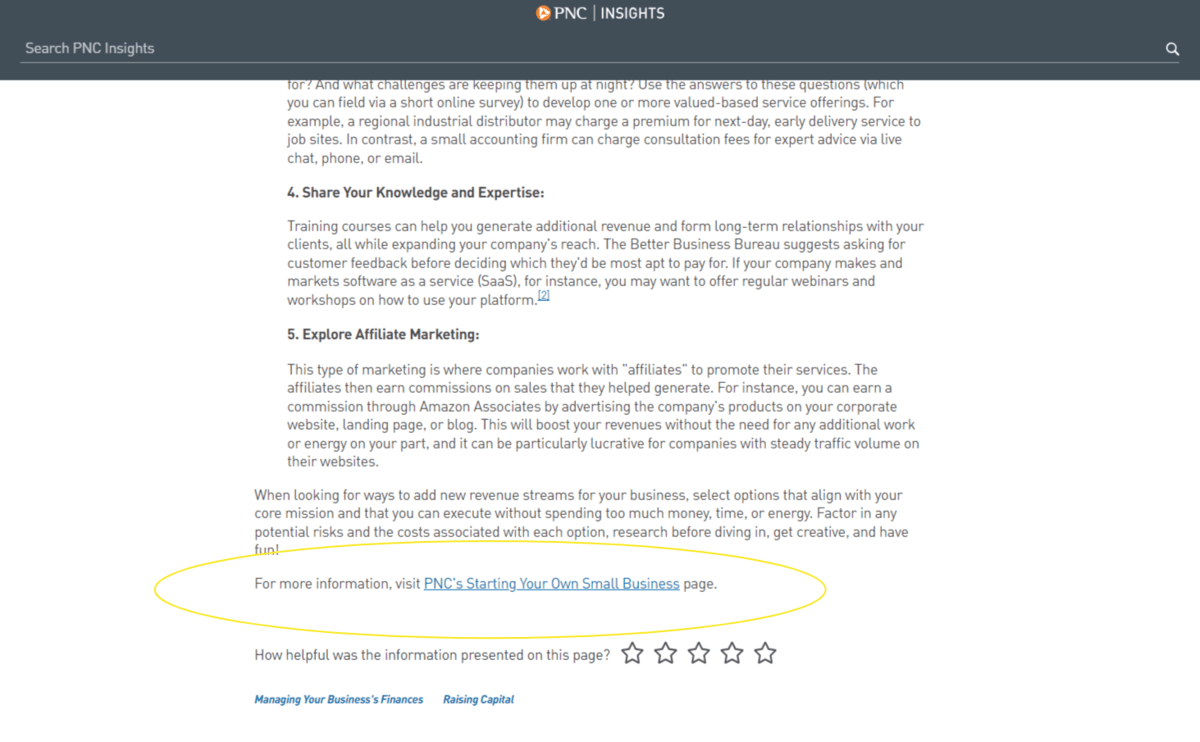

PNC does this at the bottom of some but not all of its articles. Here’s an example of how it’s presented at the end of this post about finding new sources of revenue:

It’s a single-line call to action inviting small business owners to visit a dedicated page that expands on these tips. Even then, they’re not pushing readers to sign up for a business checking account or anything like that. It’s more of a way to show them that PNC is a trusted resource for this type of content and guidance.

This same 80/20 rule and approach applies to content you create for all your channels. It’s especially important to abide by this rule on social media and in email marketing. If you want to get people to follow or subscribe, and to remain engaged with your content, it needs to answer that big question of “What’s in it for me?” as much as possible.

As you’ve seen from some of the banking content I’ve already shown you, a lot of the topics and themes focus on educating people on money management. While a bank’s content can be somewhat promotional in terms of pushing people toward certain products, that doesn’t leave much room for other types of semi-promotional content.

Namely, I’m talking about content that helps existing customers get more from your products and services. In addition, this content should help them navigate the challenges of moving from physical banking to digital banking.

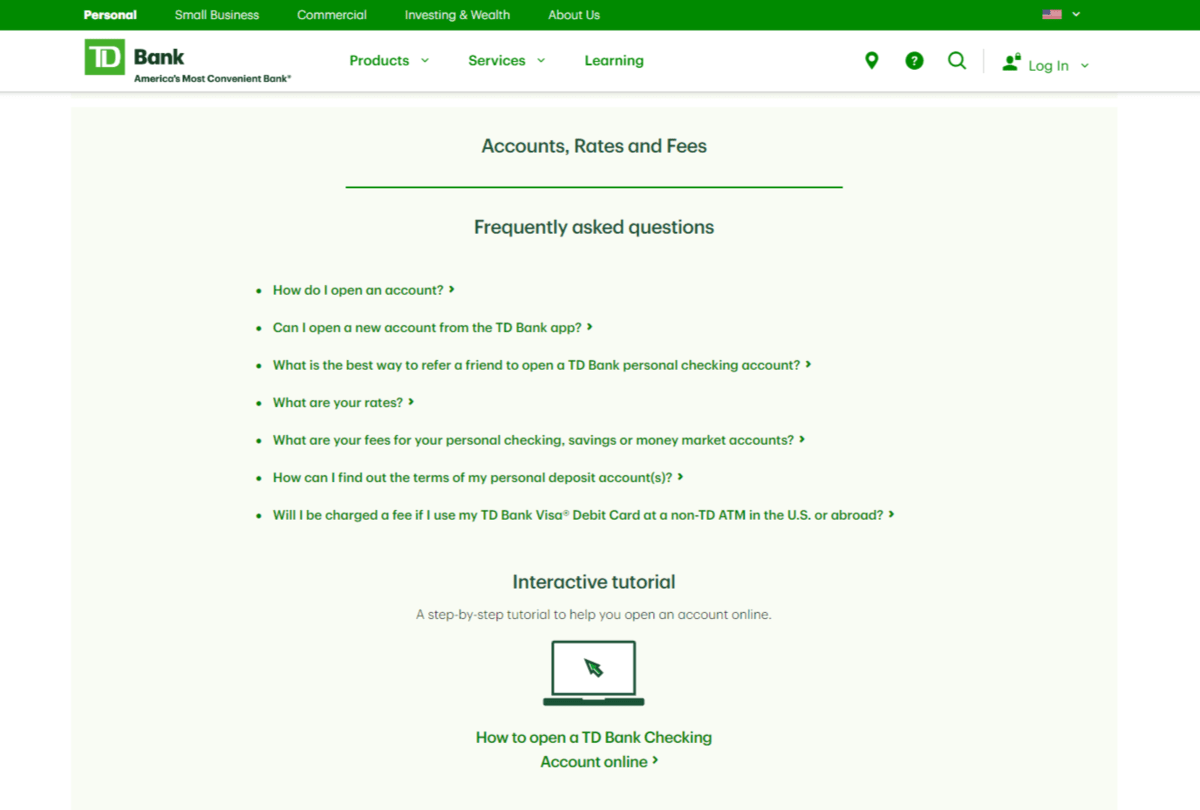

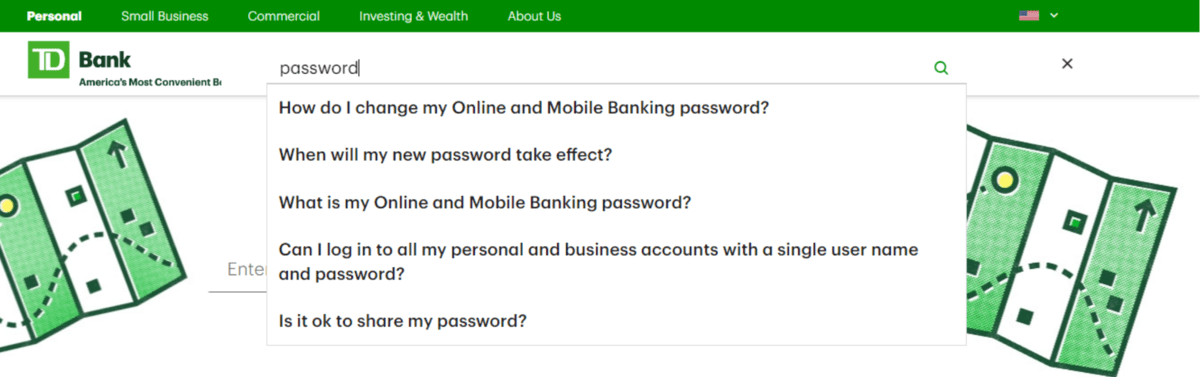

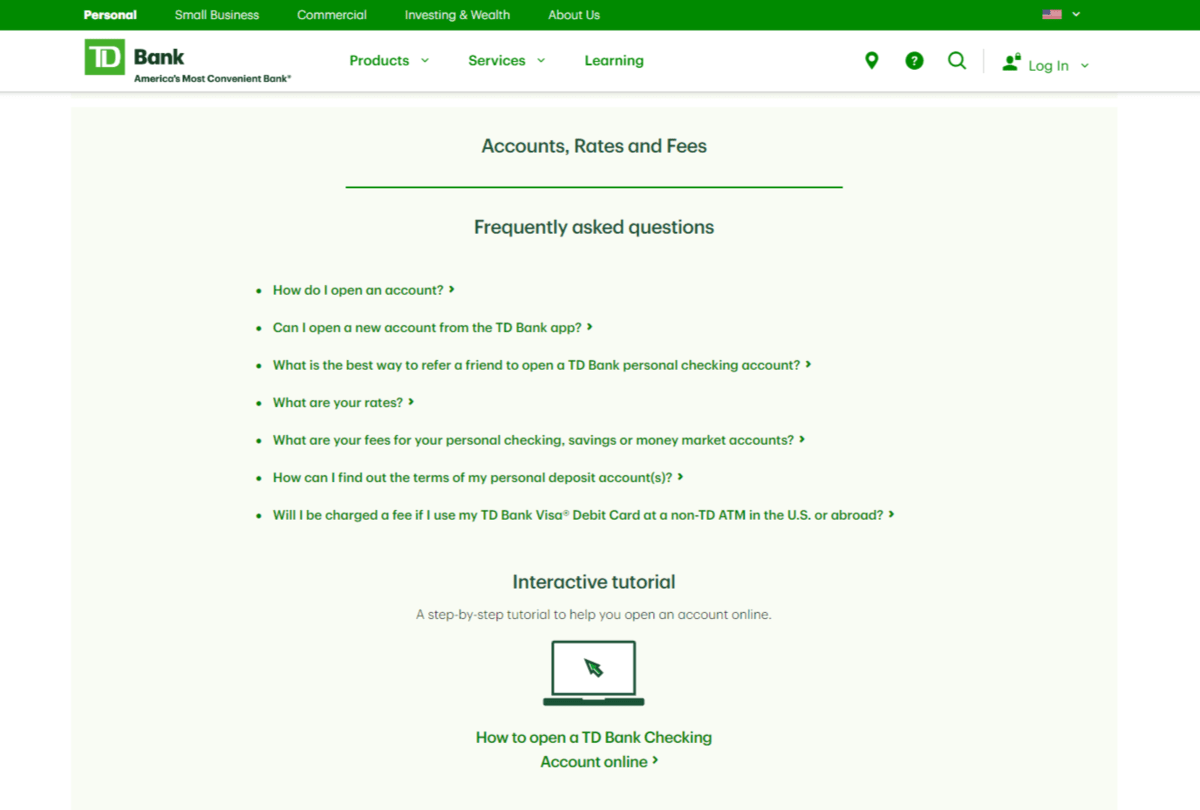

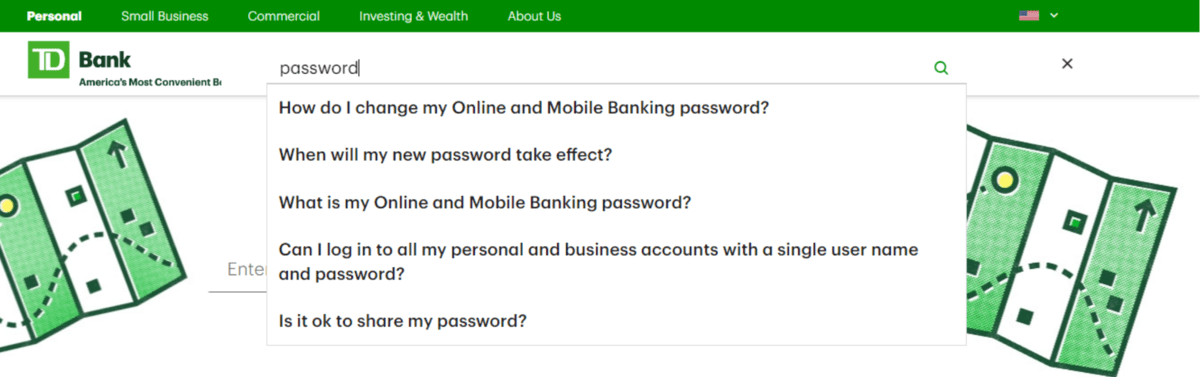

This kind of content belongs in a bank’s online help center. TD Bank’s Help Center is a good example to check out:

When users click on the question mark icon in the header, they get access to all kinds of useful content related to their TD Bank account.

The search bar at the top comes equipped with predictive search results and can also be used to find relevant answers and guides in the Help Center.

A search bar is always a good tool to include in your digital products as it takes the onus off of your customers to dig through the help center archives to get the help they need. It also makes them less likely to pick up the phone to call for help.

Another neat feature in this Help Center is the interactive tutorials that show users how to use the TD Bank mobile app:

If you’re trying to get more customers to adopt your mobile banking app, including visual tutorials like this one will be hugely helpful for customers. It would also be a good way to demonstrate to older users and non-techie users how easy it is to use your banking app.

They don’t necessarily need to be interactive as these ones are. They could be short YouTube videos or GIFs.

That said, smart content is definitely the direction that hi-tech companies are moving in. So if you want your financial organization to keep up with leaders in fintech, you’ll look for ways to integrate AI chatbots, machine learning-powered search and interactive content into your customer service content strategy.

There are different ways to personalize content. Banks can’t just take any data they’ve collected on customers and then use it to send out hyper-personal messages on various channels.

For instance, you wouldn’t want to run a retargeting ad on Facebook that says, “Overdraft your account a second time this month? Learn how to keep it in the black from now on.” That’s way too personal and insensitive of a subject matter to target customers with.

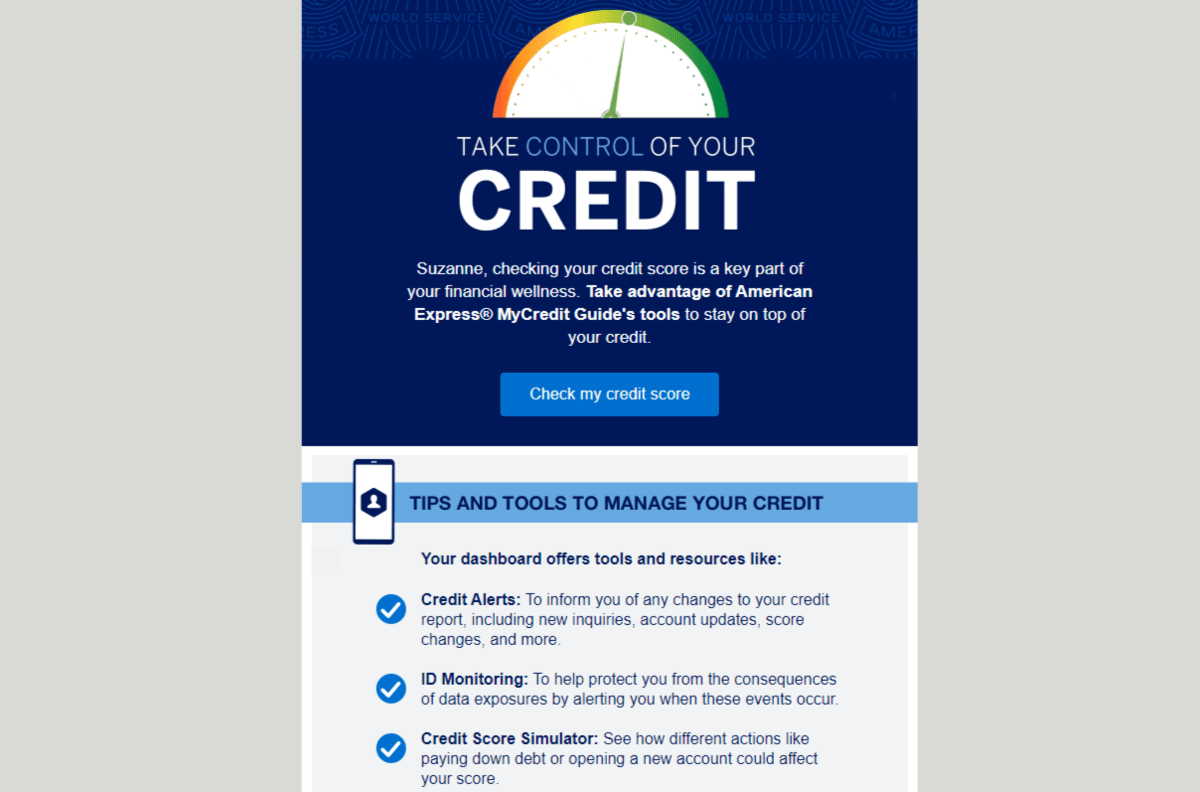

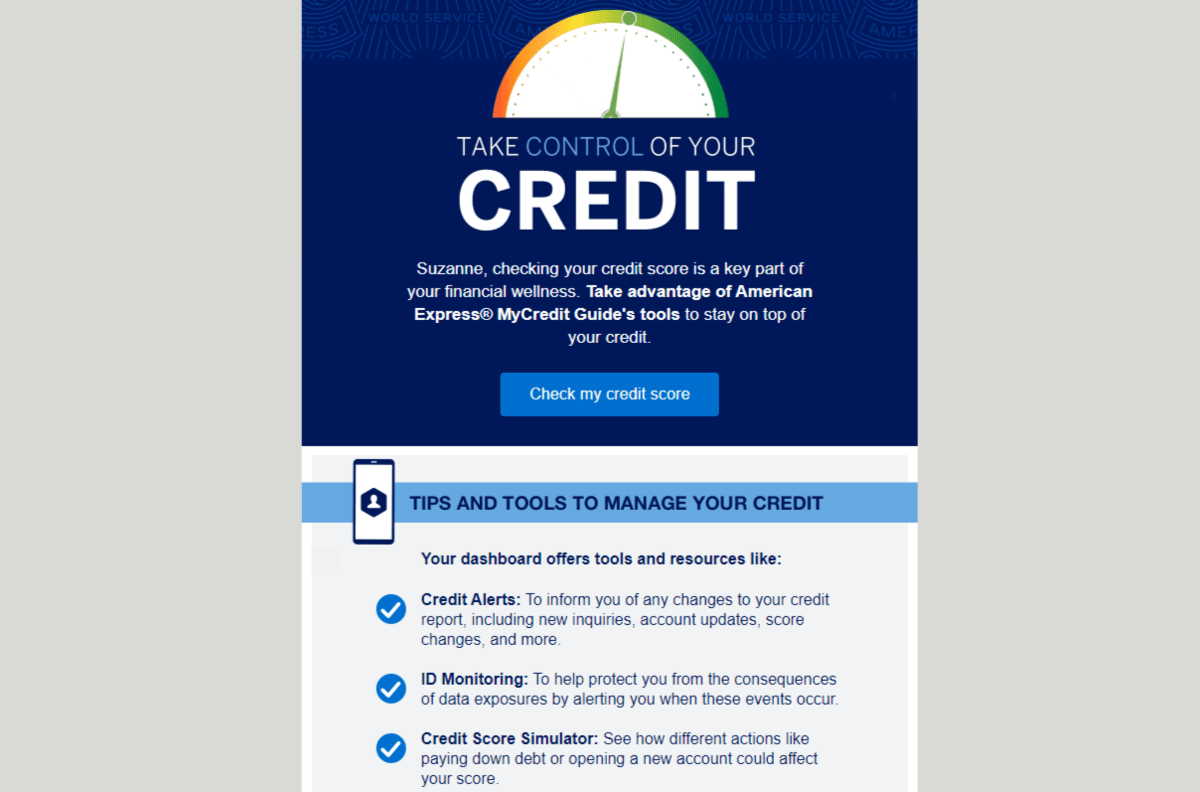

When it comes to personalization, it’s best to go the conservative approach just as you do when crafting your content. Here’s an email example from American Express:

About once a month, American Express emails me something like this. There’s nothing in here that’s specific to me or my actual credit score aside from them addressing me by my first name.

That said, while this email is ultimately an invitation to log into my account and view my credit score, it also gives me helpful tips on monitoring and managing it. Since this is something I had indicated that I’m interested in and it’s a feature on the site I use often, this kind of personalized messaging is nice to receive.

There are other ways to offer personalized content. For instance, the one I touched on earlier is serving up personalized blog content and resources to logged-in users in your mobile app. You can do the same on your website. By tailoring content and recommendations based on the users’ accounts, interests and goals, you’ll find them more eager to read through and interact with it on a regular basis.

There are different ways to gather this kind of information from your users. One option is to use the data you collect on users and different segments of users. This will allow you to hypothesize about what they’d like to see.

If you want something more concrete, you can ask them explicitly what kind of content they want more of and will be useful to them. You can give them space in their account settings to indicate those preferences. But not every user may see that.

Another option is to give them a form or survey to fill out. WSFS Bank, for instance, has a Product Finder form. This is a personalized form in two ways. First, the form asks different questions based on the responses the user gives. Second, it provides users with personalized recommendations on which banking products to get.

While this tool connects customers to new financial products, it could be repurposed for other types of data collection. Like to help a bank learn more about individual customers’ interests, goals and content preferences.

Banks can’t afford to rest on their laurels or to take their customers for granted. There are countless banking options now available to consumers—ones that offer not just a secure place to manage their money, but also a better customer experience.

Traditional financial institutions can make themselves stand out by offering an omnichannel customer experience that’s positive, helpful and valuable. And the content they create for these channels will play an important role in this.

But creating high-quality content isn’t enough. Without a strategy to inform how you create this content or a system to manage it all, it won’t be as effective.

That’s where a digital experience platform like Sitefinity CMS comes into play. Omnichannel content marketing doesn’t need to be difficult or intimidating. With a single platform to help you develop and manage content, gather insights, and optimize your campaigns (among other things), your banking institution can stay ahead of the curve no matter how many new hi-tech solutions enter the market.

Want to see a real-life use case? See how Homestreet Bank worked with SilverTech to launch a compliant, scalable website within 90 days.

Continue reading...

How do people choose who to bank with these days? For starters, it’s no longer a choice based on which banking institutions are nearby or offer the most convenient access to ATMs. Consumers can manage all of their financial transactions from their computers or smartphones.

It’s not simply a matter of moving from physical to digital banking though. The success of fintech has shown us that consumers want hi-tech features and enhanced experiences.

As traditional financial institutions begin to catch up to online-only banks in terms of technology, there remains yet another challenge for them to tackle. And it has to do with their approach to marketing.

In the following post, we’re going to look at seven things that traditional banking institutions can do to level up the customer experience via their content marketing strategy. If they want to compete in this digital economy, content is the way to get and stay ahead.

Tips for Improving the Customer Experience with Content

Because fintech was born online, these companies have easily mastered the art of providing an outstanding customer experience via content marketing. It’s part of their DNA.

It’s time now for traditional financial institutions to catch up. Here are some ways to do it:

1. Know Your Customer

Every successful content strategy starts with user research. For banks, this is an especially important step. Unlike, say, a web design agency that targets small business owners and entrepreneurs, banks typically serve everyone. So you can’t just create content for one particular segment of your customers and not the other. Nor can you write content for everyone and make your blog or knowledge center be a free-for-all.

What you’ll need to do first is identify the major user segments that you serve and want to create content for. Let’s use the example of Regions Bank.

The Resources area of the navigation contains “Insights” (i.e., articles) for different customer segments:

- Personal banking customers

- Small business customers

- Commercial clientele

- Wealth management clients

This segmentation of content enables Regions Bank to tailor their content to their different customers’ financial needs and goals. It also makes it easy for users to find relevant content from the navigation. This wouldn’t be possible for Regions Bank to do if they didn’t know their customers well.

Identifying your customer personas is just the first step. You also need to understand what your typical customer’s journey looks like. For example:

- Stage 1: Researching financial service providers and account types

- Stage 2: Gathering information on your bank

- Stage 3: Opening an account

- Stage 4: Using and getting accustomed to their new account

- Stage 5: Taking advantage of the rewards associated with their account

You want to create valuable and informative content for people at every stage, even if they’re not your customers yet. But the more you get to know the people you’re targeting, the better-crafted your content will be. That could be the difference between them deciding to open an account with your financial institution versus a fintech solution or another bank.

2. Make Your Content Strategy Omnichannel

Omnichannel customer experience (CX) is a holistic and integrative approach to serving customers.

At the core of this experience sits your digital products. So your website and mobile app need to be reliable, secure, intuitive and useful. They also need to seamlessly work with and talk to each other so your customers can pick up where they left off with ease.

Always On, Always Relevant: Driving Business Success Through Omnipresent Marketing

Explore Gene De Libero’s theory that these three vital strategies highlight the changing face of consumer engagement: multichannel, omnichannel and omnipresent marketing.

In addition, your digital products should be built for their unique use cases. For instance, a bank’s website is a useful tool for attracting prospective customers via SEO, blogging and free resources. The app, on the other hand, is a good tool for onboarding customers and giving them real-time access to all the tools and insights they need to manage their money.

Omnichannel CX takes into account everything else your bank does online and offline. For example:

- Social media marketing

- Transactional emails

- Email marketing

- Pay-per-click online ads

- Search engine optimization

- Print and broadcast ads

- Billboards and other physical signage

The content you publish to any one of these channels should factor in your different user segments while also accounting for the context in which the content appears.

Let’s look at Fulton Bank’s blog:

This is a great educational resource for banking customers as well as non-customers. They’ll learn about things like saving and budgeting, investing, home ownership, managing debt and more.

But when you go to Fulton Bank’s Instagram, you won’t find the same kind of content:

The Instagram page is really about putting a face to the Fulton Brand bank and its customers. It demonstrates how much this financial institution cares about its customers and communities. At the same time, it fits perfectly within the larger Fulton Bank brand.

This is what a great omnichannel strategy looks like. Customer-centric content that’s custom-made based on the platform. And each platform seamlessly integrates with the company’s digital products and other channels.

3. Spend Time Creating the Right Kind of Content for Your Digital Products

When it comes to deciding what type of content to share, banks generally have to play it more conservative.

On a website, you’ll almost always find a blog along with free resources. The Advice section of the USAA website is a good example of how to present this kind of content:

The top of the Advice page has a list of the blog’s categories:

- Finances

- Insurance

- Auto

- Home

- Military Life

- Retirement

- Family Disasters

When users scroll down, they’ll find the blog feed as well as a list of resources like the Auto Loan Calculator, Mortgage Payment Calculator and Military Separation Checklist.

Many of these resources are interactive, conversational tools. They’re built to feel like you’re talking with a financial advisor and being carefully guided through the process of making some of life’s biggest financial decisions.

Banks have to create content for their other channels as well.

On mobile apps, for instance, users should be shown more personalized content. That’s the benefit of making a digital product specifically for customers that you’ve collected data from. Rather than give them a blog full of generic advice, you can provide them with meaningful advice and insights that relate to their accounts, activity and goals.

4. Create an 80/20 Content Marketing Strategy

When traditional banking institutions didn’t have fintech to contend with, they could get away with product-driven marketing.

“Sign up for a checking account and get $250 today!” might have been the messaging that appeared in online ads, mailers, Instagram posts and on the website. But the modern consumer doesn’t want to have products and services pushed on them without first understanding:

WHAT’S IN IT FOR ME?

This is why the 80/20 content marketing strategy is the way to go when pivoting to a customer-centric approach. This means that 80% of what you create is high-value content that’s non-promotional.

The PNC Insights blog is a good example of how to build trust in your bank and its products through high-quality content:

The remaining 20% of your content can be promotional, but it should still take an empathetic approach. If you want to sell to the digital consumer, then you can’t make it only be about what you’re selling. You have to give them a reason to seriously consider it.

Another way to approach this is to shape the content you write to be 80% non-promotional and 20% promotional. The way that usually works is to tackle a super valuable topic and spend the majority of the article unpacking it. Then, in the conclusion, you offer up your banking product or service as a potential solution.

PNC does this at the bottom of some but not all of its articles. Here’s an example of how it’s presented at the end of this post about finding new sources of revenue:

It’s a single-line call to action inviting small business owners to visit a dedicated page that expands on these tips. Even then, they’re not pushing readers to sign up for a business checking account or anything like that. It’s more of a way to show them that PNC is a trusted resource for this type of content and guidance.

This same 80/20 rule and approach applies to content you create for all your channels. It’s especially important to abide by this rule on social media and in email marketing. If you want to get people to follow or subscribe, and to remain engaged with your content, it needs to answer that big question of “What’s in it for me?” as much as possible.

5. Make Your Customer Service Content Just as Great

As you’ve seen from some of the banking content I’ve already shown you, a lot of the topics and themes focus on educating people on money management. While a bank’s content can be somewhat promotional in terms of pushing people toward certain products, that doesn’t leave much room for other types of semi-promotional content.

Namely, I’m talking about content that helps existing customers get more from your products and services. In addition, this content should help them navigate the challenges of moving from physical banking to digital banking.

This kind of content belongs in a bank’s online help center. TD Bank’s Help Center is a good example to check out:

When users click on the question mark icon in the header, they get access to all kinds of useful content related to their TD Bank account.

The search bar at the top comes equipped with predictive search results and can also be used to find relevant answers and guides in the Help Center.

A search bar is always a good tool to include in your digital products as it takes the onus off of your customers to dig through the help center archives to get the help they need. It also makes them less likely to pick up the phone to call for help.

Another neat feature in this Help Center is the interactive tutorials that show users how to use the TD Bank mobile app:

If you’re trying to get more customers to adopt your mobile banking app, including visual tutorials like this one will be hugely helpful for customers. It would also be a good way to demonstrate to older users and non-techie users how easy it is to use your banking app.

They don’t necessarily need to be interactive as these ones are. They could be short YouTube videos or GIFs.

That said, smart content is definitely the direction that hi-tech companies are moving in. So if you want your financial organization to keep up with leaders in fintech, you’ll look for ways to integrate AI chatbots, machine learning-powered search and interactive content into your customer service content strategy.

Check out this blog post highlighting six industries making smart use of chatbots: Chatbot Industry Use Cases and Examples.

6. Personalize Content and Offers

There are different ways to personalize content. Banks can’t just take any data they’ve collected on customers and then use it to send out hyper-personal messages on various channels.

For instance, you wouldn’t want to run a retargeting ad on Facebook that says, “Overdraft your account a second time this month? Learn how to keep it in the black from now on.” That’s way too personal and insensitive of a subject matter to target customers with.

When it comes to personalization, it’s best to go the conservative approach just as you do when crafting your content. Here’s an email example from American Express:

About once a month, American Express emails me something like this. There’s nothing in here that’s specific to me or my actual credit score aside from them addressing me by my first name.

That said, while this email is ultimately an invitation to log into my account and view my credit score, it also gives me helpful tips on monitoring and managing it. Since this is something I had indicated that I’m interested in and it’s a feature on the site I use often, this kind of personalized messaging is nice to receive.

There are other ways to offer personalized content. For instance, the one I touched on earlier is serving up personalized blog content and resources to logged-in users in your mobile app. You can do the same on your website. By tailoring content and recommendations based on the users’ accounts, interests and goals, you’ll find them more eager to read through and interact with it on a regular basis.

There are different ways to gather this kind of information from your users. One option is to use the data you collect on users and different segments of users. This will allow you to hypothesize about what they’d like to see.

If you want something more concrete, you can ask them explicitly what kind of content they want more of and will be useful to them. You can give them space in their account settings to indicate those preferences. But not every user may see that.

Another option is to give them a form or survey to fill out. WSFS Bank, for instance, has a Product Finder form. This is a personalized form in two ways. First, the form asks different questions based on the responses the user gives. Second, it provides users with personalized recommendations on which banking products to get.

While this tool connects customers to new financial products, it could be repurposed for other types of data collection. Like to help a bank learn more about individual customers’ interests, goals and content preferences.

Wrapping up

Banks can’t afford to rest on their laurels or to take their customers for granted. There are countless banking options now available to consumers—ones that offer not just a secure place to manage their money, but also a better customer experience.

Traditional financial institutions can make themselves stand out by offering an omnichannel customer experience that’s positive, helpful and valuable. And the content they create for these channels will play an important role in this.

But creating high-quality content isn’t enough. Without a strategy to inform how you create this content or a system to manage it all, it won’t be as effective.

That’s where a digital experience platform like Sitefinity CMS comes into play. Omnichannel content marketing doesn’t need to be difficult or intimidating. With a single platform to help you develop and manage content, gather insights, and optimize your campaigns (among other things), your banking institution can stay ahead of the curve no matter how many new hi-tech solutions enter the market.

Want to see a real-life use case? See how Homestreet Bank worked with SilverTech to launch a compliant, scalable website within 90 days.

Continue reading...