D

David Kaaret

Guest

The standardization of payments messages with ISO 20022 transforms the financial landscape. It revolutionizes financial communication, enhances data quality and customer experiences and elevates security and governance of the messages. Read on to learn how your institution can benefit from the standardized messaging format.

The ISO 20022 standard is coming to the world of payments, and its implementation initiatives are growing on a global scale. The nature of international payments is complex. A universal, standardized exchange of messages between financial institutions is critical for their performance and will ease the quick and economic processing of payments.

While the migration to the standard is mandatory and comes with many challenges that impact the operations of financial institutions, it also brings many benefits. Chief among them are improvements to payments processing, analytics and time to market.

Currently, financial institutions abide by different messaging standards, leading to a disconnected payments environment and inconsistent language used for inbound and outbound payments. This often necessitates human intervention, greater spend and processing delays. With the ISO 20022 standard, the world of finance can rely on a universal messaging standard. This standard is an essential element for the modernization of financial operations—facilitating richer insights and analytics, trust and innovation.

The migration to ISO 20022 offers a wide range of benefits to businesses. The quicker the migration to the new standard happens, the quicker the benefits can be realized by businesses. The following are some of the main business benefits.

Here are a few of the ways ISO 20022 can improve time to market of payments and other projects:

Common Dictionary

A primary goal of ISO 20022 is to build a common resource for components, structure and their meaning—and illustrate the context in which specific terms should be applied (e.g., for a specific nation or internationally). Having a uniform messaging structure allows financial institutions to have enhanced payments information. For example, terms and concepts used in one area, like ATM Management, are reused in other areas, such as Payment Initiation.

Once you have implemented payments, you have gone a long way towards handling your other ISO 20022 needs in areas like Credit Card payments, FX trades and Securities Clearing. Development based on ISO 20022 can be very scalable.

Enhanced Data

ISO 20022 includes significantly more enriched data flows and information in the payment messages. Attributes like LEI and BIC (Business Identifier Code) make solving common requirements like fraud detection much easier to implement. Financial institutions are enabled to make informed choices, develop safer and more effective products and provide exceptional customer service—freeing up compliance teams to focus on genuine fraud possibilities.

Common Structures and Descriptions

ISO 20022 provides descriptions for business concepts and a model of the payment’s workflow and its elements (payments, payers, payees, agents, etc.). These formats provide a wide scope for reuse of development efforts when addressing new use cases.

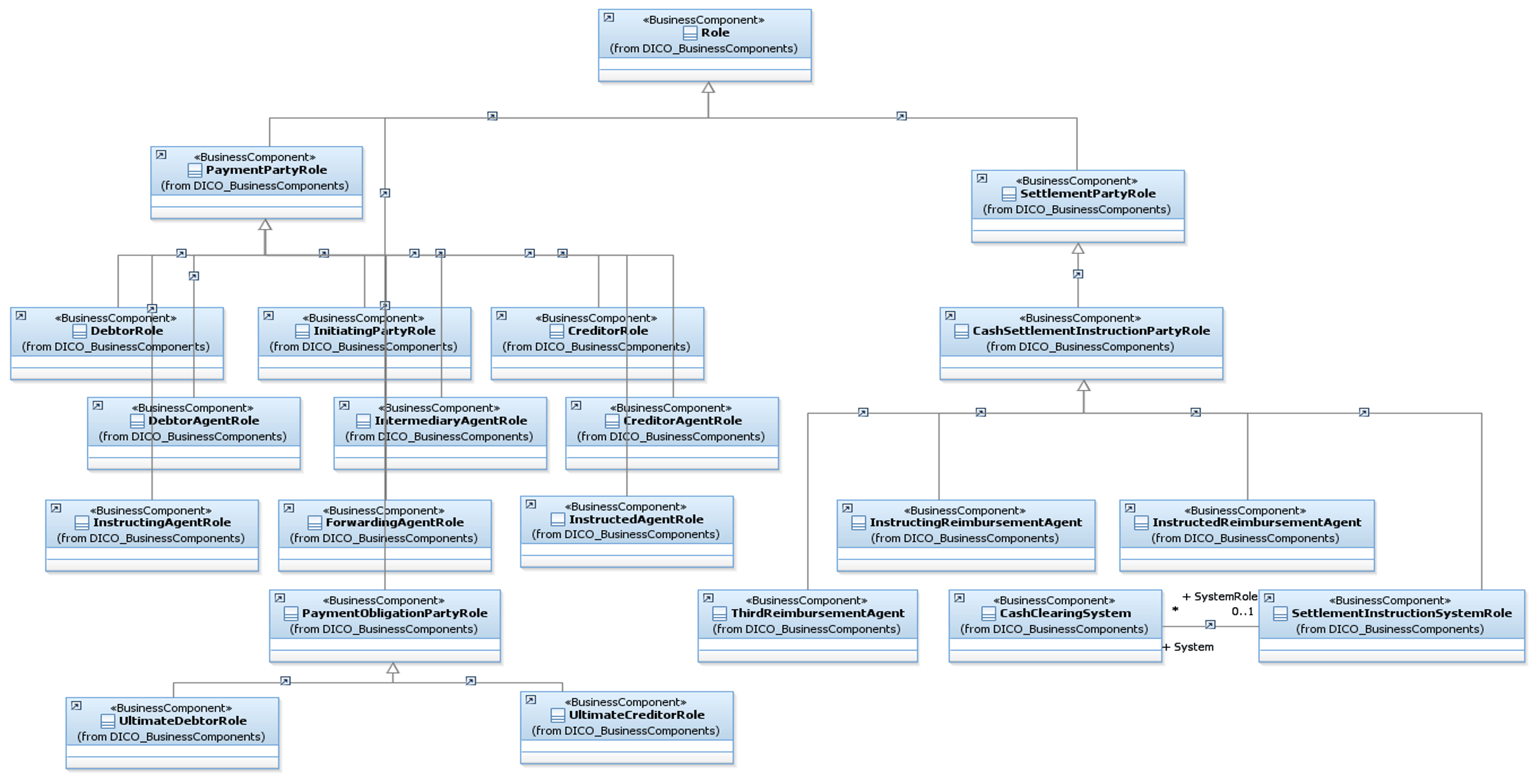

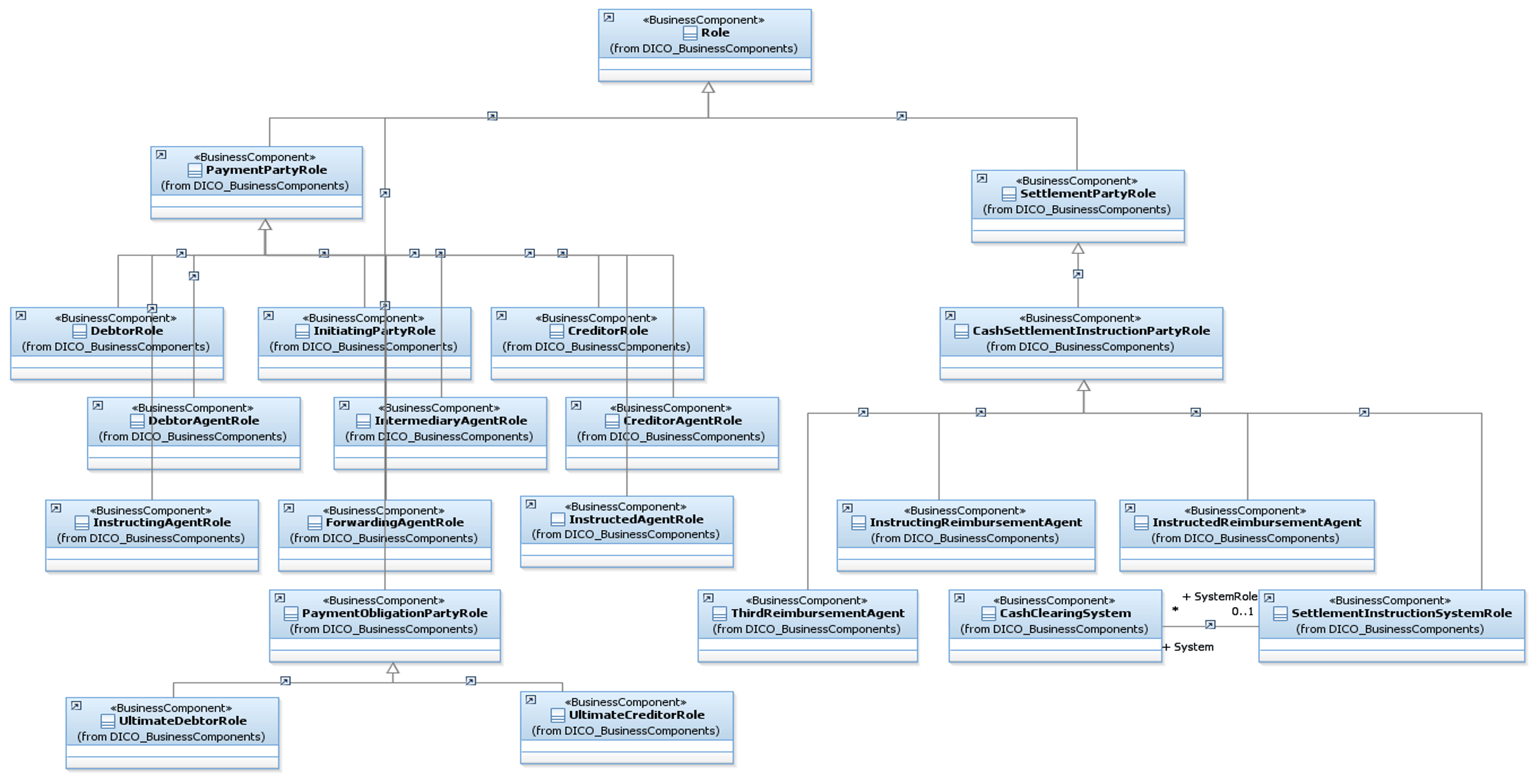

This image from ISO 20022’s business model for payments demonstrates how ISO 20022 links payments concepts at a global level.

Having common concepts centrally managed, even when used by different business functions within an institution, makes it far easier to add new use cases and functionality to existing applications. Work done to implement common concepts like “contract” or “party” can be reused with minor enhancements in new areas. The more complete information maintained for individual concepts (as compared to SWIFT MT) also makes it easier to build a reusage infrastructure.

Data is one of the most valuable assets companies have, and they should capitalize on its value to uncover insights and leverage data analytics. The use of common data structures and terms throughout different message types simplifies the building of message/data repositories by reducing the need for data integration and harmonization. Data standardization through ISO 20022 payment messages makes it easier for businesses to build dashboards and resolve complex customer queries—enabling them to dive deeper into their data and discover trends.

ISO 20022 is explicitly designed to create smooth, end-to-end processing for the entire payments chain. The upcoming move to ISO 20022 in payments is focused on a subset of over 800 different message types spread out over a variety of business types. Some of these message types include:

This allows companies to use the defined messages above in the message flows for specific business transactions.

Moreover, it abstracts the creation of the data dictionary and common data structures from the physical processing of trades. In other words, with legacy payment messages, codes and concepts were defined on an ad hoc basis for narrow purposes. With ISO 20022, the concepts are created first. That means when a specific message type needs to use a concept, it uses the same version of the concept everyone else uses rather than create a custom take on it. This makes it easier to reuse existing work as the codes and concepts mean the same thing in different scenarios.

Although the default format for ISO 20022 is XML, it is designed to support other data formats. So, ISO 20022 messages can easily be converted to other formats, and the data can be accessed by APIs. ISO 20022 creates a logical model of the information needed for a business activity and allows its infrastructure to be used for both messages and API calls, providing increased flexibility in its usage.

Moving to a complex, XML-based messaging standard has its challenges. The resulting infrastructure will support the development of robust applications that can be used for fraud detection, payment failure, customer analytics, marketing and reconciliation.

At a technical level, the ISO 20022 standard:

The ISO 20022 standard is a significant event in the financial industry. While there may be many challenges that businesses have to overcome during the planning and implementation stages, there are many benefits of ISO 20022 that should not be overlooked. The standard is a critical solution for the industry, ensuring greater efficiency, safety and transparency of payments among businesses.

To take full advantage of the ISO 20022 standard, it is imperative to construct payments projects on technology designed to meet the requirements of the new payments landscape. Progress MarkLogic greatly eases that effort, ensuring easy integration, enhanced data quality and innovation in the ever-changing financial environment.

Start your journey with ISO 20022 implementation by getting a demo of MarkLogic today.

Contact Us

Continue reading...

Benefits of Adopting the ISO 20022 Standard in Your Organization

The ISO 20022 standard is coming to the world of payments, and its implementation initiatives are growing on a global scale. The nature of international payments is complex. A universal, standardized exchange of messages between financial institutions is critical for their performance and will ease the quick and economic processing of payments.

While the migration to the standard is mandatory and comes with many challenges that impact the operations of financial institutions, it also brings many benefits. Chief among them are improvements to payments processing, analytics and time to market.

Why Is ISO 20022 So Important?

Currently, financial institutions abide by different messaging standards, leading to a disconnected payments environment and inconsistent language used for inbound and outbound payments. This often necessitates human intervention, greater spend and processing delays. With the ISO 20022 standard, the world of finance can rely on a universal messaging standard. This standard is an essential element for the modernization of financial operations—facilitating richer insights and analytics, trust and innovation.

Key Benefits of Adopting ISO 20022 Standard

The migration to ISO 20022 offers a wide range of benefits to businesses. The quicker the migration to the new standard happens, the quicker the benefits can be realized by businesses. The following are some of the main business benefits.

Time to Market

Here are a few of the ways ISO 20022 can improve time to market of payments and other projects:

Common Dictionary

A primary goal of ISO 20022 is to build a common resource for components, structure and their meaning—and illustrate the context in which specific terms should be applied (e.g., for a specific nation or internationally). Having a uniform messaging structure allows financial institutions to have enhanced payments information. For example, terms and concepts used in one area, like ATM Management, are reused in other areas, such as Payment Initiation.

Once you have implemented payments, you have gone a long way towards handling your other ISO 20022 needs in areas like Credit Card payments, FX trades and Securities Clearing. Development based on ISO 20022 can be very scalable.

Enhanced Data

ISO 20022 includes significantly more enriched data flows and information in the payment messages. Attributes like LEI and BIC (Business Identifier Code) make solving common requirements like fraud detection much easier to implement. Financial institutions are enabled to make informed choices, develop safer and more effective products and provide exceptional customer service—freeing up compliance teams to focus on genuine fraud possibilities.

Common Structures and Descriptions

ISO 20022 provides descriptions for business concepts and a model of the payment’s workflow and its elements (payments, payers, payees, agents, etc.). These formats provide a wide scope for reuse of development efforts when addressing new use cases.

This image from ISO 20022’s business model for payments demonstrates how ISO 20022 links payments concepts at a global level.

Having common concepts centrally managed, even when used by different business functions within an institution, makes it far easier to add new use cases and functionality to existing applications. Work done to implement common concepts like “contract” or “party” can be reused with minor enhancements in new areas. The more complete information maintained for individual concepts (as compared to SWIFT MT) also makes it easier to build a reusage infrastructure.

Analytics

Data is one of the most valuable assets companies have, and they should capitalize on its value to uncover insights and leverage data analytics. The use of common data structures and terms throughout different message types simplifies the building of message/data repositories by reducing the need for data integration and harmonization. Data standardization through ISO 20022 payment messages makes it easier for businesses to build dashboards and resolve complex customer queries—enabling them to dive deeper into their data and discover trends.

Payments Processing

ISO 20022 is explicitly designed to create smooth, end-to-end processing for the entire payments chain. The upcoming move to ISO 20022 in payments is focused on a subset of over 800 different message types spread out over a variety of business types. Some of these message types include:

- acmt: Account Management

- catp: ATM Card Transactions

- pacs: Payments Clearing and Settlement

- pain: Payments Initiation

- reda: Reference Data

This allows companies to use the defined messages above in the message flows for specific business transactions.

Moreover, it abstracts the creation of the data dictionary and common data structures from the physical processing of trades. In other words, with legacy payment messages, codes and concepts were defined on an ad hoc basis for narrow purposes. With ISO 20022, the concepts are created first. That means when a specific message type needs to use a concept, it uses the same version of the concept everyone else uses rather than create a custom take on it. This makes it easier to reuse existing work as the codes and concepts mean the same thing in different scenarios.

Although the default format for ISO 20022 is XML, it is designed to support other data formats. So, ISO 20022 messages can easily be converted to other formats, and the data can be accessed by APIs. ISO 20022 creates a logical model of the information needed for a business activity and allows its infrastructure to be used for both messages and API calls, providing increased flexibility in its usage.

Moving to a complex, XML-based messaging standard has its challenges. The resulting infrastructure will support the development of robust applications that can be used for fraud detection, payment failure, customer analytics, marketing and reconciliation.

At a technical level, the ISO 20022 standard:

- Supports the creation of links between messages and business processes.

- Provides common reference points for all the transactions it covers, like payments. Terms are used consistently across different message and transaction types. In other words, ISO 20022’s focus is on building its dictionary. With a common vocabulary, implementing business processes and interoperability with other systems is greatly simplified.

- Enables adding new message types and reuse of existing infrastructure.

- Enhances documentation and structure of messages and processes.

The ISO 20022 standard is a significant event in the financial industry. While there may be many challenges that businesses have to overcome during the planning and implementation stages, there are many benefits of ISO 20022 that should not be overlooked. The standard is a critical solution for the industry, ensuring greater efficiency, safety and transparency of payments among businesses.

To take full advantage of the ISO 20022 standard, it is imperative to construct payments projects on technology designed to meet the requirements of the new payments landscape. Progress MarkLogic greatly eases that effort, ensuring easy integration, enhanced data quality and innovation in the ever-changing financial environment.

Start your journey with ISO 20022 implementation by getting a demo of MarkLogic today.

Contact Us

Continue reading...